New Business Phones Can Provide Substantial Tax Benefits

November 6th, 2012 by admin

Acquire New Equipment/Software Before The End Of 2012 And Uncle Sam Makes The First 14 Payments For You!*

There are only two months left in the year to take advantage of the tax benefits offered to small and mid-sized businesses with Internal Revenue Code (IRC) Section 179. The tax benefit targets businesses who are contemplating large equipment purchases, such as technology, and significantly reduces the cost of purchasing such equipment. Section 179 allows business owners to write-off the entire cost, up to $560,000, on new equipment purchases made by December 31st, 2012.

Many Americans were left wondering how the Stimulus Package would have an impact on their lives and Section 179 has answered that question for many business owners. Creating significant savings on major purchases of equipment, software or phone systems, the federal government enacted this bill in an effort to spur business-to-business spending. Section 179 does come with limits - there are caps to the total amount written off ($139,000 in 2012), and limits to the total amount of the equipment purchased ($560,000 in 2012). The deduction begins to phase out dollar-for-dollar after $560,000 is spent by a given business, so this makes it a true small and medium-sized business deduction.

2012 Deduction Limit = $139,000

This is good on new and used equipment, as well as off-the-shelf software.

2012 Limit on equipment purchases = $560,000

This is the maximum amount that can be spent on equipment before the Section 179 Deduction available to your company begins to be reduced.

Bonus Depreciation = 50%

This is taken after the $560k limit in capital equipment purchases is reached. Note: Bonus Depreciation is available for new equipment only. Bonus Depreciation can also be taken by businesses that will have net operating losses in 2012.

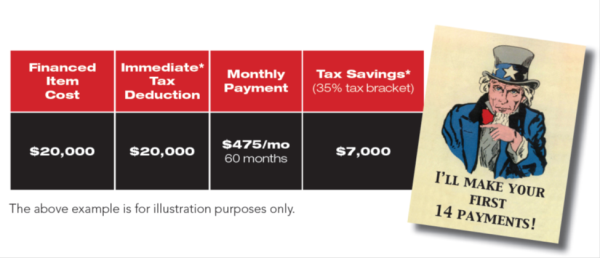

Here is an example of Section 179 at work:

While every transaction is different and tax professionals should be consulted on specific situations, the potential rewards of this government program has persuaded many business owners to seriously consider investing in new equipment before year-end. The one caveat associated with this powerful program is that the new equipment must be in use by December 31, 2012, in order to qualify for the massive savings. Many business owners have installed new business phone systems as a result of this addition to the tax code because recent breakthroughs in telecommunications are enabling businesses to collaborate better, faster and more efficiently with one another.

Posted in: Uncategorized